In a world where unexpected expenses can pop up like a surprise bill, unsecured personal loans have become an increasingly popular solution for those in need. Whether it’s funding home renovations, covering medical bills, or even planning your dream wedding, these loans offer flexibility and convenience that many other financial tools simply don’t provide.

What is an Unsecured Personal Loan?

An unsecured personal loan, also known as a signature loan, does not require collateral. Instead, lenders approve the borrower based on their creditworthiness alone. This means you aren’t putting up any of your assets to secure the loan, making it a riskier proposition for banks but potentially more accessible for borrowers.

For many individuals seeking immediate funding without the hassle of tying up valuable assets, an unsecured personal loan can be a lifesaver. These loans typically offer fixed interest rates and predictable monthly payments over a set period, from 2 to 5 years or sometimes longer.

Benefits of Unsecured Personal Loans

- Flexibility in how you spend the funds – pay off high-interest credit card debt, cover medical expenses, fund home improvements, plan vacations, etc.

- Predictable monthly payments with fixed interest rates that don’t change over time. This makes it easier to budget and manage your finances.

- Ability to build or rebuild credit by making timely repayments on the loan.

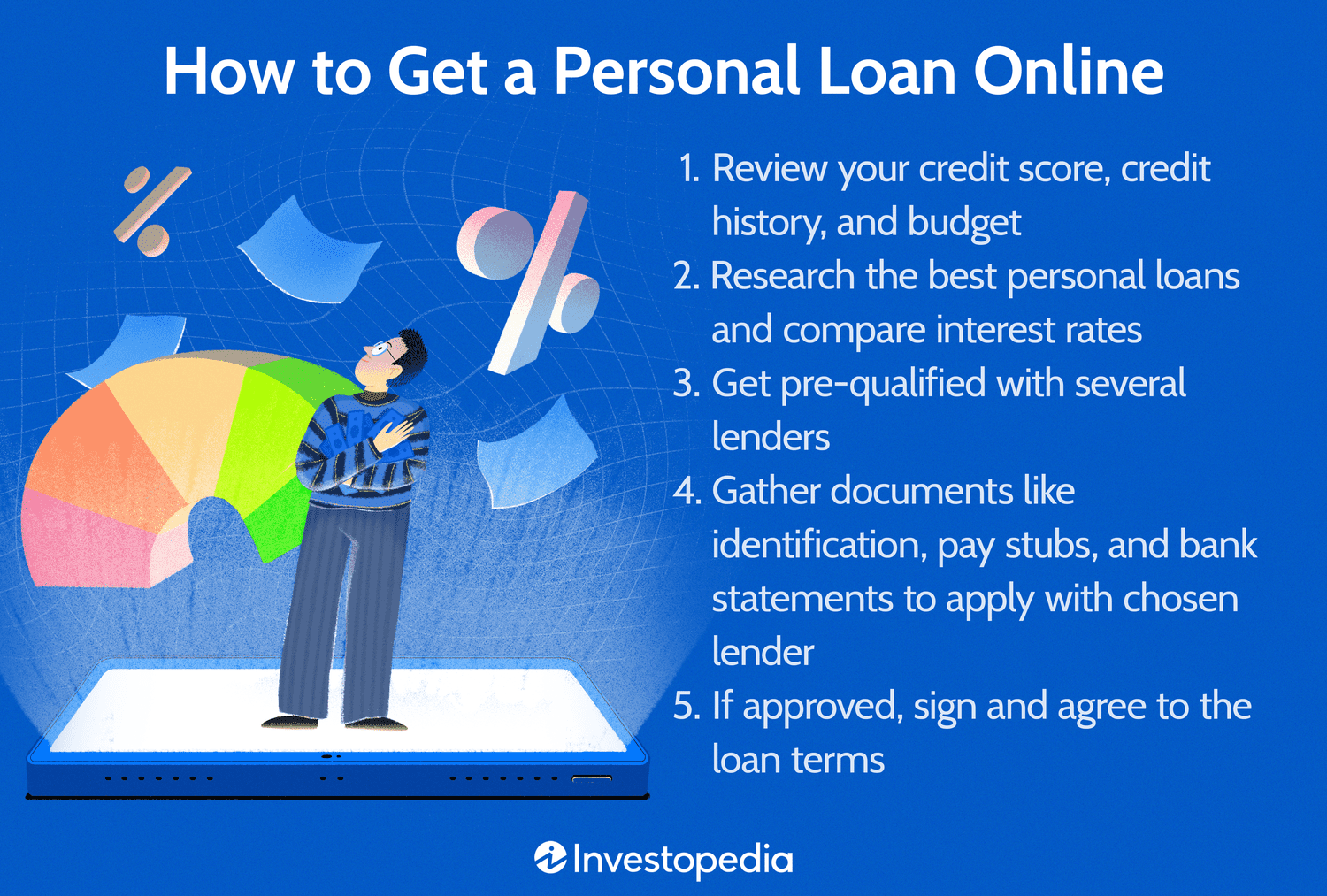

The Process of Applying for an Unsecured Personal Loan

The application process for these loans is relatively simple compared to other types of borrowing. Typically, you’ll need to provide your personal information like name, address, employment status, and income level. You will also be asked about the purpose of the loan, how much money you are seeking, and what repayment period suits you best.

One important step before finalizing the application is prequalification or a soft credit check, which gives you an idea if you’re eligible for the loan without affecting your credit score negatively. Once approved, organizing necessary documents such as proof of identity (driver’s license), bank statements, employment verification, and tax returns can help speed up the process.

How Unsecured Personal Loans Stack Up Against Credit Cards

While both unsecured personal loans and credit cards allow you to borrow money without collateral, there are significant differences in how they work:

| Credit Card | Unsecured Personal Loan |

| Variable interest rates that can change monthly. | Fixed interest rate, providing more stability in budget planning. |

| Potential for endless revolving credit with minimum payments due each month. | Limited to a set loan amount you agree upon at the time of application. |

| Typically lower borrowing limits compared to personal loans ($10,000 max). | Possibility of larger loan amounts (up to $50,000 or more). |

If you’re considering an unsecured personal loan as a means to consolidate credit card debt and potentially lower your interest rate, it’s wise to do some calculations first. A personal loan calculator from fastlendgo.com can provide insight into how much you could borrow based on your financial situation.

Qualifying for an Unsecured Personal Loan

Lenders evaluate borrowers using various factors to decide whether or not to extend a personal loan. These typically include:

- Your credit score: This is often the most critical factor in determining eligibility and interest rate.

- Your income level: Lenders want assurance that you can afford monthly payments without financial strain.

- Employment status: A steady job with consistent income shows stability to lenders.

- Total debt ratio: The amount of existing debt compared to your total earnings is another key consideration.

For those who find it challenging to qualify due to low credit scores or insufficient income, co-signers can play a pivotal role. By having someone with strong financial standing co-sign the loan application, you increase your chances of approval and may secure better terms.

However, before agreeing to such an arrangement, consider the potential risks involved. If you default on repayments, both parties will face negative consequences including damaged credit scores and legal actions initiated by lenders.

Smart Borrowing Practices for Unsecured Personal Loans

As with any form of borrowing, it’s crucial to approach unsecured personal loans responsibly. Here are some tips to ensure you make the most out of your loan while minimizing risks:

- Shop around for lenders and compare rates to find the best deal possible.

- Estimate what amount you truly need rather than opting for maximum limits offered by lenders.

- Review all terms carefully, including repayment periods, monthly payments, fees, and any additional perks or discounts available from different lenders.

Another critical step is checking your credit report before applying. This allows you to identify any inaccuracies that could negatively impact approval chances and interest rates.

When to Consider an Unsecured Personal Loan

Unsecured personal loans can be incredibly useful when used responsibly:

- To consolidate multiple high-interest debts into a single loan with potentially lower interest.

- Funding unexpected emergencies like medical bills or urgent home repairs.

- Planning significant life events such as weddings, vacations, or educational expenses not covered by scholarships and grants.

Before taking out any form of unsecured personal loan, ensure it aligns with your long-term financial goals. While these loans can offer quick relief during tough times, they should be viewed as tools to manage rather than solutions for chronic overspending habits.

In summary, while every borrower’s situation is unique and requires careful consideration, an unsecured personal loan can serve as a lifeline in times of need. By understanding the ins and outs of these loans, you position yourself to make informed decisions that align with your financial health.